The Big Picture

To survive and succeed in a hot market, a company must be willing to change everything about itself except its basic beliefs…. Give the individual full consideration, spend a lot of time making customers happy, go the last mile to do a thing right.

–Thomas J. Watson, Jr., former Chief Executive of IBM. From Fortune (August 31, 1987).

THE CRUCIAL ISSUE FACING PHARMACEUTICAL COMPANIES TODAY

For research-based pharmaceutical companies, the most critical issue today is maintaining a flow of new, innovative drugs that ensure the company’s growth and even survival. Most pharmaceutical companies are fully committed to this challenge because the alternative of having a dry period without new products is unattractive and its consequences are clear. To meet the challenge, companies are adopting strategies of developing their drugs on a global basis using state-of-the-art technologies and attempting to improve their efficiency of drug discovery and development. Companies primarily obtain their new drugs from in-house research discoveries, licensing from other companies or groups, or joint ventures with (or acquisitions of) other companies, primarily in the biotechnology area. This book describes the state-of-the-art standards that exist in many aspects of drug discovery and development.

Another response to the challenge of preventing dry periods without new products is to conduct a detailed analysis of the entire research and development (R and D) process and seek ways of improving current systems, organizational structures, and approaches. These internal evaluations used to occur approximately once in a five- to ten-year period and often involved an outside consulting firm. At the present time, this process tends to occur on a more frequent basis or even on a continual basis. This book provides specific techniques to help managers judge a company’s strengths and weaknesses, and many detailed methods used to analyze a pharmaceutical company or its R and D activities are presented.

The world of drug discovery and development is rapidly changing, and there is a need for companies to take a broad view to develop useful strategies and take advantage of opportunities. The information explosion in the published literature provides details of technical aspects of drug discovery and development on a daily basis. The press, trade associations, and numerous other sources provide information about the pharmaceutical industry as a whole (or selected parts) to the public and to healthcare professionals. There are no sources, however, that provide a broad view of the many issues of drug discovery and development from a company’s perspective. That is the primary intention of this book.

FUNCTIONS OF DRUGS

When Sir Walter Raleigh was facing the headman’s ax in his final moments, he reportedly said, “It’s a sharp drug, but it cures all ills.” Many people believe that drugs are intended to “cure all ills,” but relatively few drugs actually cure a disease. Most have other functions, primarily to treat symptoms. These functions are briefly described because, during the drug discovery process, scientists are consciously seeking to find a compound with specific properties or functions. During clinical development, one or more of these functions are specifically studied. The various uses or functions of drugs can be arbitrarily divided into six categories.

Prevention. Some drugs are used prophylactically to prevent disease. Drugs such as vaccines or fluoride may be given to normal individuals to prevent the initial occurrence of a disease (e.g., polio, smallpox, or dental carries) or may be given to patients at high risk of contracting a certain disease or problem to reduce the chance of its occurrence. Another form of disease prevention is sometimes called suppression (see category 4).

Cure. The ideal form of treatment occurs when drugs are used to cure a disease (e.g., antibiotics are used to cure certain bacterial infections, or anthelmintics are used to cure certain worm infections). A cure represents a complete eradication of the disease, including the underlying cause (e.g., the presence of viruses or bacteria in cells).

Treatment. Drugs are often used to alleviate symptoms for patients who have a chronic disease. These drugs do not cure a disease and usually do not affect the underlying pathophysiology (e.g., antiasthmatics or antianginals), but the drugs improve the patient’s signs and/or symptoms and lead to clinical improvement. Drugs that reduce the risk of disease progression illustrate a type of treatment.

Suppression. Drugs are often used to suppress the signs and/or symptoms of a disease and prevent them from occurring or to prevent the disease process from progressing. Suppression is often a continuation of therapy after the acute episode or problem has improved and is referred to as maintenance therapy. Suppression is a type of prevention but is used in patients who have a disease as opposed to normal persons who want to prevent getting a disease. Examples are antiepileptic or antimigraine drugs given after an acute episode to prevent recurrences.

Diagnosis. Some drugs are used to help physicians establish the diagnosis of a patient’s disease or problem (e.g., radio-contrast dyes). It would be desirable if there were many drugs available for this purpose, but relatively few such drugs exist. Drugs are sometimes used for a short time as a therapeutic trial to help prove a diagnosis. It is assumed that if a patient improves after a therapeutic trial with a drug, then the diagnosis is proven. If the patient does not improve, then the conclusion is reached that the diagnosis is incorrect. This practice is considered to be an undesirable way of using drugs in many situations (e.g., to use antibiotics without obtaining cultures that demonstrate the presence of a bacteria) because physicians should assiduously attempt to diagnose medical problems before initiating treatment.

Enhancement of health. People desire the best state of health possible. Many try and achieve this state through drugs (e.g., vitamins and minerals) as well as through other means (e.g., diet and exercise). These drugs cannot be said to be replacing a deficiency, and some may only offer a psychological sense of well-being. Dietary supplements are another example of this category.

Many drugs fit into two or more of these categories. Such drugs may be used for either one or two functions at the same time. One example of this latter situation is illustrated with the Fab antibody fragment of digoxin. This drug (Digibind) simultaneously diagnoses and treats life-threatening digoxin toxicity by binding molecules of digoxin in the blood, making them unavailable for binding at their site of action on cells in the body. If the patient has toxicity resulting from a digoxin overdose, then he or she will usually be helped by the drug. If the patient does not have a digoxin-induced toxicity, then the drug will be ineffective. Some drugs that usually fit in one category may also be used for other purposes. One example is when antibiotics are used prophylactically in high-risk patients to prevent development of a bacterial infection (e.g., during dental procedures in patients who have had rheumatic heart disease) as well as ther-apeutically in others to cure many specific infections.

OVERALL PERSPECTIVE OF PHARMACEUTICAL COMPANIES

Uniqueness of the Pharmaceutical Industry

It is critically important for senior executives to have a detailed understanding of their industry. This helps them reach more informed and sometimes better decisions about many important issues, policies, and questions that frequently arise. Yet, one often reads speeches of a pharmaceutical company’s chief executive or senior company officers who may be top lawyers, financiers, or marketing experts but who do not understand the basic concepts and processes of how drugs are discovered and developed. The

various factors that influence drug discovery and development may also not be well understood. Although most companies may be operated and managed as if they make “widgets,” a pharmaceutical company must not.

various factors that influence drug discovery and development may also not be well understood. Although most companies may be operated and managed as if they make “widgets,” a pharmaceutical company must not.

Major factors that differentiate pharmaceutical companies from other companies are listed below. Some of these factors are only a matter of degree, including: (a) the long period of time required to develop and market a newly discovered drug; (b) the high degree of financial risk and uncertainty of a drug’s future, even after it is launched; (c) the large number of highly restrictive regulations that govern all aspects of a drug’s development, production, and marketing; (d) the inability to predict when the next important drug discovery will occur; and (e) the large number of variables and factors that are involved in biological experiments, technical development, and especially clinical trials. This last point means that a large number of interpretations of information is possible in many situations. Each of these critical aspects means that it is essential to have as full an understanding of the drug discovery and development process as possible. It is also important to understand the factors that relate to creating and maintaining an appropriate environment in which drug discovery will flourish.

The pharmaceutical industry shares some characteristics with many other industries, including other high-technology industries, as follows:

A rapidly changing environment in which products are sold. Many of these changes are highly unpredictable, both in the nature and rate of change.

Competition in all areas of importance (e.g., product discovery, development, and marketing)

Many aspects of the corporate environment in which these activities take place are nuances of the corporate culture. Corporate culture shapes the strategies used by a company to develop drugs and is discussed in several other chapters of this book. This culture-strategy interaction is also discussed by Shrivastava and Guth (1985).

Attributes of Pharmaceutical Companies

Many individuals, especially those who have limited time to devote to an issue or question, want to understand “the big picture.” In some circles, this cliché is as common as “the bottom line” (i.e., the overall impression or amount). The big picture obtained after looking at a pharmaceutical company includes consideration of its (a) core and other businesses, (b) overall size, (c) current and planned activities, (d) profitability, (e) approaches to drug discovery and development, and (f) current portfolio of marketed and investigational drugs.

Core and Other Businesses

Is the company strictly a pharmaceutical company, a healthcare company, or a company engaged in a wide variety of businesses? If the latter, how does the drug business fit into the company’s overall mission? Some large companies seem to go through cycles of divesting nonpharmaceutical businesses and acquiring them.

Overall Size

This aspect may be described in terms of sales per year, numbers of workers, assets, or other factors. Size does not necessarily correlate with profit or number of drugs marketed. This topic is described more in Chapter 19.

Current and Planned Activities

This aspect primarily relates to whether the company is research based, licenses its drugs and develops them, and/or is a generic company. Another aspect is whether the company works with biologics or possibly devices or combinations of these types of products. This topic is described throughout this book.

Profitability

The relative profitability of a pharmaceutical company may be based on a comparison with other pharmaceutical companies or on a between-industry comparison with other companies of the same size. A few means of illustrating a company’s profitability are illustrated in Chapter 52, and establishing prices is discussed in Chapter 98.

Approaches to Drug Discovery and Development

Companies vary from those that utilize highly formal approaches to drug development to those that emphasize flexibility. This aspect is described throughout this book. Organizational structures are primarily described in Chapters 19 and 41.

Current Portfolio of Marketed and Investigational Drugs

The portfolio of marketed drugs may include multisource (i.e., drugs susceptible to generic competition), patent-protected, or otherwise protected (e.g., with exclusivity under the Orphan Drug Act or under Hatch-Waxman provisions of the law) drugs. Drugs under development (i.e., investigational drugs) are assessed by the medical and commercial value of the company’s portfolio of potential new products (see Chapter 52).

Pharmaceutical Costs and Profits

A significant part of the “big picture” relates to profits. The Food and Drug Administration (FDA) regulations and guidelines since 1962 have required many more premarketing studies to be conducted than previously. Good Laboratory Practices and Good Manufacturing Practices regulations have also increased the costs of bringing a new drug to market. Regulations, however, are only one of many factors that have resulted in the higher prices charged for drugs. Other factors include the steadily mounting costs for laboratory equipment, clinical trials, staff salaries, and other components of drug discovery and development. As a result of increased healthcare expenditures during the 1960s and 1970s, the government reacted. It has taken various steps (e.g., encouraging generic competition, passing maximum allowable cost regulations, and providing bonuses to pharmacists who dispense generic drugs) to force drug prices down. Food and clothing prices, however, have been kept artificially high by government price support programs for agriculture and tariffs and import quotas on foreign textiles.

The major reason why pharmaceutical companies are willing to invest hundreds of millions in high-risk research is that the rates of return for the few commercially successful drugs are also high. If the rates of return are markedly diminished, as is already occurring in some countries, pharmaceutical companies will be much less willing in the future to invest their money in research. Economic analyses clearly show that, if regulations diminish profits for pharmaceutical companies on their few successful drugs below a certain minimum, the companies will reduce the investments they are willing to make in research. Without sufficient research, drug discovery will be slowed, and this will decrease the rate at which new drugs will reach the market.

Competition within the Pharmaceutical Industry

An additional piece of the “big picture” is the risk from competition. Competition within the pharmaceutical industry exists on several levels. These include (a) being first to enter new therapeutic markets, (b) price and other types of competition (e.g., perceived benefits) on similar products within a single therapeutic market, and (c) manufacturing generic versions of the same drug. The evidence that supports the view that there is significant competition in the pharmaceutical industry includes (a) price flexibility on specific products; (b) instability of market share over a period of a few years; (c) high rate of corporate mergers, buyouts, and bankruptcies; and (d) licensing arrangements.

Perspectives of Different Groups about New Pharmaceuticals

When drug discovery and development issues are being presented and discussed, numerous perspectives could be used. These include those of various groups both within and outside the pharmaceutical industry. Representative groups within the industry would include people in marketing, production, science, medical, and technical development functions. Representative groups outside the industry include patients, physicians, and regulatory agencies. Most of this book presents the perspectives of those within the industry. Nonetheless, it is useful to review briefly the overall perspective of some groups from both within and outside the industry.

Perspectives about New Drugs by Groups within the Pharmaceutical Industry

The perspectives of pharmaceutical company employees about new drugs are somewhat influenced by their background and discipline within their company. Informed and knowledgeable people view drugs in terms of a combination of medical, scientific, and commercial parameters. Others focus more on one of these (or other) aspects of a new drug.

Many groups within and outside the pharmaceutical industry often ascribe logic to a drug’s discovery or its development that is actually a convenient teleological explanation (i.e., they work backward to derive an explanation that fits the observed events). Events usually seem clearer in hindsight when numerous activities are rearranged in people’s minds, rough edges are smoothed out, and loose threads (e.g., false leads and approaches) are conveniently forgotten or ignored. As a result, the story of many drugs’ discovery and development appears logical and orderly, whereas many false turns, accidents, and mistakes, as well as luck were involved. Lucky errors may have directed the drug along the right path to its success. Many drug discoveries have occurred and paths of development were correctly followed despite some people’s attempts to proceed in a different direction. There are a few noteworthy exceptions to this somewhat cynical view that truly illustrate a logical and stepwise approach to drug discovery and development.

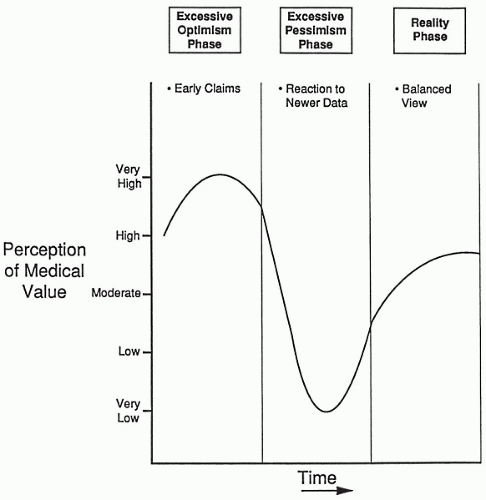

People in each company often talk about new upcoming drugs much as company stocks are described. The perceived value of a drug to a company often has precipitous changes based on casual or formal comments from the FDA, investigators, or company scientists. These changes are often more related to emotional reactions to the drug’s characteristics, uninformed judgments, or other reactions that do not reflect the drug’s true value. The perceived value of a drug to stockbrokers and to stockholders in terms of eventual profit also rises and falls precipitously based on news, which may or may not be accurate or relevant to the drug’s true value. These changes in perceived value are illustrated in Fig. 3.1.

Perspectives about New Drugs by Groups outside the Pharmaceutical Industry

The perspective about new drugs under development in groups outside the pharmaceutical industry varies widely depending on the specific drug and the specific audience. A number of generalizations, however, can be made because different groups have differing frames of reference for looking at new drugs.

Patients. Patients view new drugs in terms of hopes for improvement of symptoms, underlying disease, or risk factors. Cost of new therapy may also be a major consideration. More sophisticated patients will have at least some awareness of risks and the benefit-to-risk ratio present with the new therapy.

Regulatory authorities. Regulatory authorities view new drugs from the nation’s health perspective in terms of potential health problems resulting from adverse events as well as potential benefits. Regulatory agencies often focus on worst-case scenarios.

Competitors. Competitors within the pharmaceutical industry view a new drug as a minor to major threat to their own marketed drugs and/or new investigational drugs. In some cases, a company’s own development strategy will be markedly influenced by competitors’ progress, and in other cases, the potential competitors will be ignored.

Some perspectives of consumer advocates, trade associations, physicians, academicians, legislators, reporters, and other groups are discussed in Section 4 of this book.

SYNOPSIS OF DRUG DISCOVERY AND DEVELOPMENT

Drug Discovery

When asked for a definition of Hinduism, one religious scholar said, “It’s simple; anyone who says he is a Hindu is one.” The reason for this statement is that Hinduism has not rejected or cast out beliefs of the past but has continued to build on them and to add new beliefs. Likewise, the processes of drug discovery are multifaceted, and new ways of finding drugs are continually being added without discarding methods of the past. Thus, some people view drug discovery primarily in terms of the new methods of biotechnology or high throughput screening, whereas others emphasize the importance of computer-assisted methods of drug discovery. Neither of these relatively new approaches is the major means of discovering novel drugs, nor are the oldest methods of random screening or haphazard trial and error that have been used for over 100 years.

The major methods of discovering new drugs today are those used during the past 50 years. The most important method is the trial-and-error empirical approach. Novel compounds called analogues are made that are similar to marketed or known drugs. Other compounds are also made that are distantly related or may be totally unrelated to marketed or known drugs. These compounds are hypothesized to have biological activity and are

then tested by empirical methods using relevant animal models. Some animal models are related to human disease. If the compound is found to have biological activity of interest, it is called a chemical lead or a lead compound. If the lead is highly active, it will stimulate chemists to make many new compounds that are chemically related to the lead compound. Eventually, a compound is hopefully found that has a sufficient number of positive qualities and few negative qualities compared to existing therapy so that it justifies additional animal studies. It is usually hoped that this compound will become a drug (one possible exception is when a company develops a “research tool” to assist its search for active compounds but realizes that this compound cannot become a marketed drug). This marks the end of the drug discovery period and the start of drug development. The compound is now considered as a candidate compound for drug development.

then tested by empirical methods using relevant animal models. Some animal models are related to human disease. If the compound is found to have biological activity of interest, it is called a chemical lead or a lead compound. If the lead is highly active, it will stimulate chemists to make many new compounds that are chemically related to the lead compound. Eventually, a compound is hopefully found that has a sufficient number of positive qualities and few negative qualities compared to existing therapy so that it justifies additional animal studies. It is usually hoped that this compound will become a drug (one possible exception is when a company develops a “research tool” to assist its search for active compounds but realizes that this compound cannot become a marketed drug). This marks the end of the drug discovery period and the start of drug development. The compound is now considered as a candidate compound for drug development.

The processes of drug discovery are not straightforward. There is a certain amount of disorder in the system. Too much order and control are usually considered detrimental, although there should be a sound rationale underlying the activities conducted.

Many factors must be considered by scientists when choosing specific compounds to make and test. These issues as well as other methods of discovering drugs are discussed in Chapter 8. The one final method of drug discovery that must be mentioned is serendipity or accident. Mark Twain once aptly said that the greatest inventor of all was accident. Serendipity occurs both in preclinical laboratories as well as in clinical trials and in clinical practice. Observant scientists or physicians have made many such discoveries that have led to new drug uses.

Drug Development

Drug development is a highly complex process involving thousands of different activities. For the most part, these activities are not described in this book but may be found in references (see references and additional readings at the end of chapters). Figures 124.1 and 124.2 in the book Guide to Clinical Trials (Spilker 1991) illustrate how many of these activities are interconnected. As opposed to drug discovery, where a certain degree and type of disorder is encouraged, drug development has order, organization, and discipline as goals. Too much disorder can be highly detrimental to the process of bringing a drug to market.

After a candidate compound to be studied further as a potential drug is identified, we enter the world of drug development.

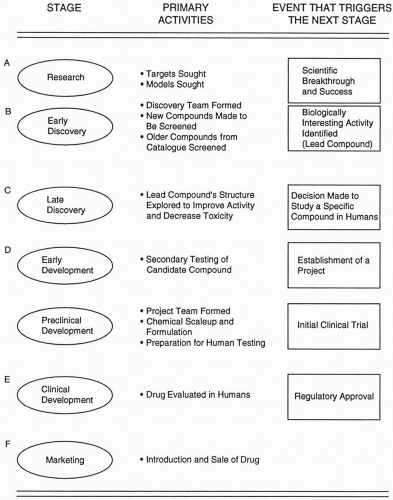

Figure 3.2 illustrates the different stages of drug discovery (i.e., Stages A to C), development (i.e., Stages D and E), and marketing (i.e., Stage F). Early activities of drug development involve an in-depth analysis of the candidate compound’s profile in additional animal studies. This period usually lasts from six to 18 months. If both the positive and negative attributes are acceptable, it means that the compound has a benefit-to-risk ratio adequate to pursue development. At that point, the candidate compound is elevated to become a project compound, which means that it will be tested in humans if it can pass other preclinical requirements. Project compounds are managed during their development by a project team whose members represent different departments within the company. In very small companies, a project team of independent consultants with at least one company representative is often assembled. This is sometimes referred to as a virtual project team.

Figure 3.2 illustrates the different stages of drug discovery (i.e., Stages A to C), development (i.e., Stages D and E), and marketing (i.e., Stage F). Early activities of drug development involve an in-depth analysis of the candidate compound’s profile in additional animal studies. This period usually lasts from six to 18 months. If both the positive and negative attributes are acceptable, it means that the compound has a benefit-to-risk ratio adequate to pursue development. At that point, the candidate compound is elevated to become a project compound, which means that it will be tested in humans if it can pass other preclinical requirements. Project compounds are managed during their development by a project team whose members represent different departments within the company. In very small companies, a project team of independent consultants with at least one company representative is often assembled. This is sometimes referred to as a virtual project team.

Figure 3.2 Major stages of drug discovery, development, and marketing indicating some of the primary activities conducted during each period and the event that triggers or initiates the next stage. |

The project compound progresses through technical development, toxicology, metabolism, and other animal studies until it receives a green light from the company, the regulatory agency, and the Institutional Review Board/Ethics Committee to be tested in humans. At the time of initial testing in humans, a project compound becomes a project drug. There are three phases of clinical trials that a drug passes through before it receives regulatory approval and may be sold as a marketed drug. In a few situations (e.g., drug for a life-threatening disease without adequate treatment or drug for a rare

disease), Phase 3 may be omitted. The clinical testing of a known drug for a new use usually begins with Phase 2 tests because the Phase 1 tests for initial safety data have already been completed.

disease), Phase 3 may be omitted. The clinical testing of a known drug for a new use usually begins with Phase 2 tests because the Phase 1 tests for initial safety data have already been completed.

Stay updated, free articles. Join our Telegram channel

Full access? Get Clinical Tree