6

Medicare and Medicaid

After completing this chapter, readers should be able to:

Define the two parts of the Medicare system.

Define the two parts of the Medicare system.

Define what is covered in the Medicare benefit program.

Define what is covered in the Medicare benefit program.

Define who is eligible for Medicare benefits.

Define who is eligible for Medicare benefits.

Describe the Medicare payment system and payment formulas.

Describe the Medicare payment system and payment formulas.

Explain guidelines when Medicare is the secondary payer.

Explain guidelines when Medicare is the secondary payer.

Describe the types of providers in the Medicare system.

Describe the types of providers in the Medicare system.

Describe the Medicare provider identifying number system.

Describe the Medicare provider identifying number system.

Describe the rules and regulations of Medicare filing.

Describe the rules and regulations of Medicare filing.

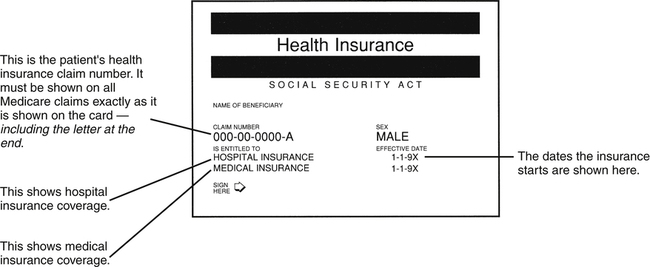

| Term | Definition |

| Beneficiary | In the Medicare program, one who is eligible to receive Medicare benefits for medical coverage or illness or injury or for death benefits. |

| CMS | Centers for Medicare & Medicaid Services. The federal agency responsible for maintaining and monitoring the Medicare program, beneficiary services, and Medicaid and state operations. |

| Correct Coding Initiative (CCI) | Bundling edits created by CMS to combine various component items with a major service or procedure. |

| FI | Fiscal Intermediary. An insurance company under contract to the government that handles claims under Medicare Part A from hospitals, skilled nursing facilities, and home health agencies. |

| HCPCS | Healthcare Common Procedure Coding System; more commonly referred to as HCPCS (sometimes pronounced “hick pix”). A coding system designed by CMS to report patient services utilizing codes from CPT and other alphanumeric codes. |

| Hospice | An organization (private or public) that provides pain relief, symptom management, and support services to terminally ill patients and their families. |

| Inquiry Letters | Request from an insurance company for additional information required to process a claim for payment. |

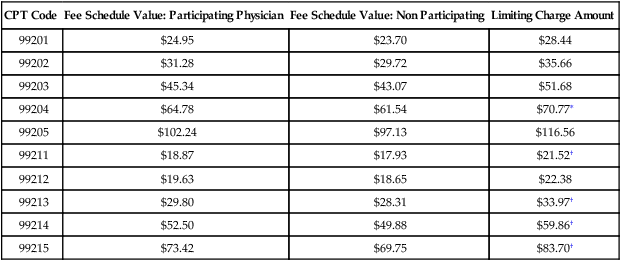

| Limiting Charge | Typically applies to Medicare reimbursement. This is the absolute maximum fee a physician may charge a Medicare patient when not accepting assignment on the claim. This fee is set by the Centers for Medicare & Medicaid Services (CMS). |

| Locum Tenens | A physician who substitutes for another physician who is out of the office for an extended period of time. |

| Medicare | A national health insurance program for persons over the age of 65 and qualified disabled or blind persons regardless of income; administered by CMS. |

| Medicare Part A | A national health insurance program for persons over the age of 65 and qualified disabled or blind persons regardless of income; administered by CMS to cover the cost of hospitalizations and nursing facility charges. |

| Medicare Part B | An elective coverage program offered by CMS for aged and disabled patients to provide benefits for physician and other medical services as part of the Medicare program. This program has a monthly premium that must be paid by the beneficiary to keep the policy in good standing. |

| Medigap | A specialized insurance policy for Medicare beneficiaries that pays deductibles and co-payment amounts not covered by the Medicare program. |

| Medi-Medi | Insurance coverage by both Medicare and Medicaid. |

| PPS | Prospective Payment System. A payment method pertaining to hospital insurance based on a fixed dollar amount for a principal diagnosis. |

| SOF | Signature on File. |

Explanation of Medicare Benefits

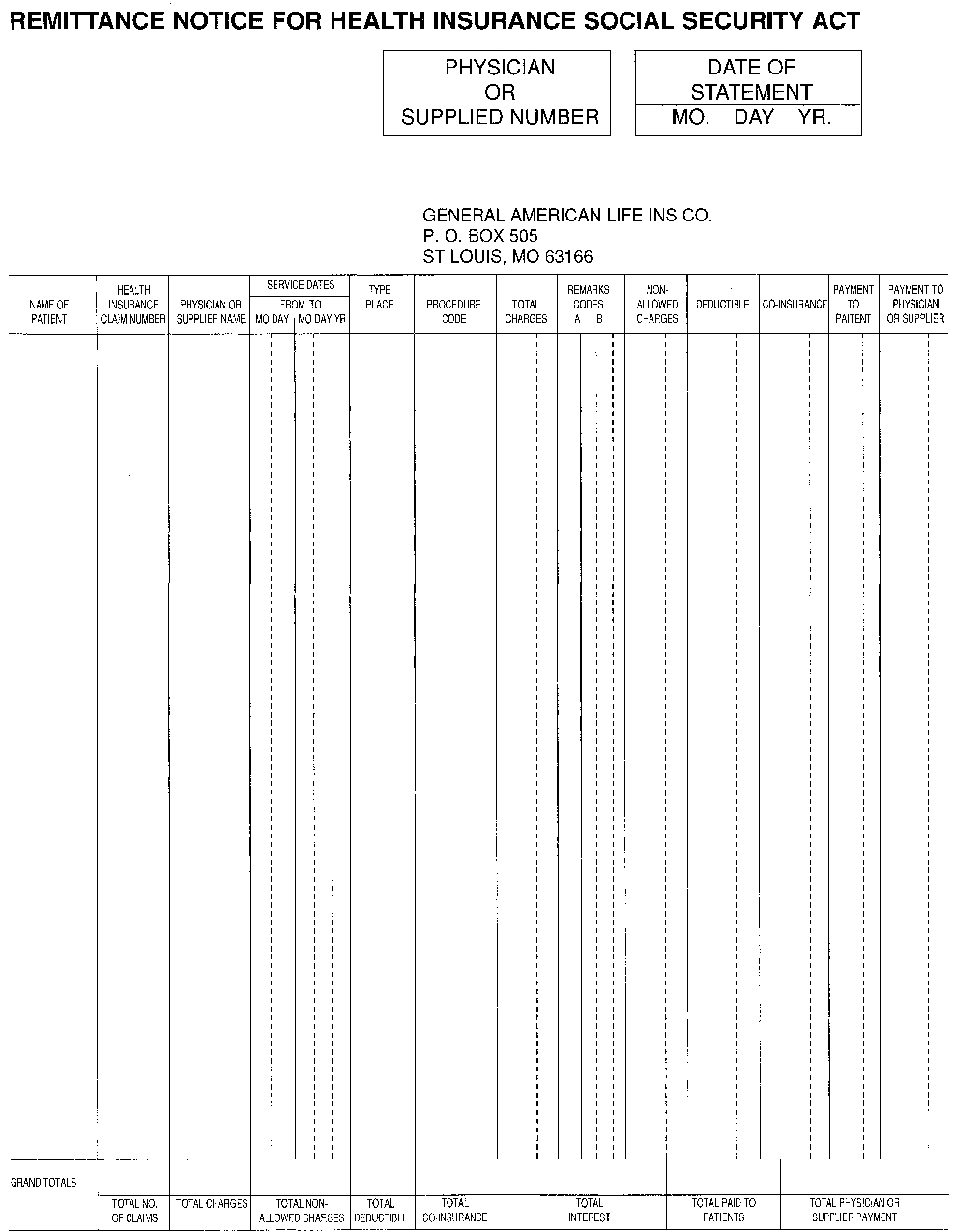

Remittance Advisory

The patient’s name and ID number.

The patient’s name and ID number.

The name and address of the person who provided the service.

The name and address of the person who provided the service.

Date, place, and type of service.

Date, place, and type of service.

Procedure or service rendered to the patient.

Procedure or service rendered to the patient.

Amount allowed by Medicare for the service.

Amount allowed by Medicare for the service.

Patient co-payment information.

Patient co-payment information.

Claim action information (e.g., if claims crossed over to another agency or carrier).

Claim action information (e.g., if claims crossed over to another agency or carrier).

Reason(s) claim was paid or denied.

Reason(s) claim was paid or denied.

See Figure 6-2 for an example of a Medicare Remittance Advisory.

The date of service, the provider of the service, and how much was charged for the service.

The date of service, the provider of the service, and how much was charged for the service.

The amount Medicare allowed for the service and the expected payment amount.

The amount Medicare allowed for the service and the expected payment amount.

Secondary Payer Provision

When the patient has coverage under a group plan or has coverage through a working spouse’s insurance program

When the patient has coverage under a group plan or has coverage through a working spouse’s insurance program

If illness or injury resulted from an automobile accident or third-party liability

If illness or injury resulted from an automobile accident or third-party liability

Veterans with a Cash Card from the VA

Veterans with a Cash Card from the VA

Work-related injuries that fall under Workers’ Compensation insurance

Work-related injuries that fall under Workers’ Compensation insurance

Stay updated, free articles. Join our Telegram channel

Full access? Get Clinical Tree