8

Accounts Receivable

After completing this chapter, readers should be able to:

Read an explanation of benefits (EOB) form.

Read an explanation of benefits (EOB) form.

Read and retrieve information from a Medicare profile.

Read and retrieve information from a Medicare profile.

Evaluate reimbursement amounts.

Evaluate reimbursement amounts.

Explain the impact of deductibles.

Explain the impact of deductibles.

| Term | Definition |

| Accepting Assignment | The provider of service agrees or is willing to accept as payment the amount allowed/approved by an insurance company as the maximum amount that will be paid for the claim. After the patient has met the annual deductible, the insurance will pay a percentage of the approved/allowed amount and the patient will have a co-payment. |

| Accounts Payable | Amounts owed by the practice to creditors for property, supplies, equipment, etc. |

| Accounts Receivable | A/R. The total amount of money owed to the physician for professional services provided to a patient. |

| Adjustment | The amount corrected on a patient ledger due to an error or the difference in the amount billed by a practice and the amount allowed by the insurance company for payment of a claim. |

| Aging Accounts | Analysis of accounts receivable that indicate delinquency of 60, 90, to 120 days. |

| Appeal | A request sent to an insurance company or other payer asking that a submitted claim be reconsidered for payment or processing. |

| Assignment | Authorization by a policy holder to allow a third-party payer to pay benefits to a heath care provider. |

| Collection Ratio | The relationship between the amount of money owed and the amount of money collected. |

| Conversion Factor | The dollar amount determined by dividing the actual charge of a service or procedure by a relative value. |

| Co-payment | The amount the insured has to pay toward the amount allowed by the insurance company for services. |

| Cycle Billing | Breaking the account receivable amounts into portions for billing at a specific date of the month. |

| Deductible | The amount the insured must pay before the insurance company will begin benefit payments. |

| Dun/Dunning | A request or message to remind a patient that the account is over due or delinquent. |

| EOB | Explanation of Benefits. Form accompanying an insurance remittance with a breakdown and explanation of payments for a claim. Also referred to as a remittance advisory (RA). |

| EOMB | Explanation of Medicare Benefits. Form accompanying an insurance remittance with a breakdown and explanation of payments for a claim. |

| Fee Schedule | An established price set by a medical practice for professional services. |

| Inquiry | Checking or tracing a claim sent to an insurance company to determine payment or processing status. |

| Ledger Card | A record to track patient charges, payments, adjustments, and balances due. |

| Limiting Charge | Typically applies to Medicare reimbursement. This is the absolute maximum fee a physician may charge a Medicare patient when not accepting assignment on the claim. This fee is set by the Centers for Medicare & Medicaid Services (CMS). |

| Open Account | Accounts that are subject to charges from time to time. |

| Posting | A process of transferring account information from a journal to a ledger. |

| Professional Courtesy | A discount or fee exception given to a patient at the discretion of the physician. |

| Profile | A list of CPT codes used by a physician with a corresponding fee that is usually calculated and maintained by a third-party payer. |

| RBRVS | Resource-Based Relative Value Scale. A system of assigning values to CPT codes developed for Medicare to determine reimbursement amounts for services. |

| Relative Value Unit (RVU) | A method to calculate fees for services. A unit is translated into a dollar value using a conversion factor or dollar multiplier. The assigned value is generally based on three factors: physician work component, overhead practice expense, and malpractice insurance. |

| Review | Process of looking over a claim to assess payment amounts. |

| Skip | A patient who owes a balance on the account who has moved without a forwarding address. |

| Specificity | Using ICD-9-CM codes to the highest degree of certainty. Using fourth and fifth digits, as appropriate, while avoiding over use of the unspecified codes. |

| Statement | An itemized bill sent to the patient describing professional services provided. A request for payment. |

| Superbill | A multipurpose billing form to track procedure and diagnosis codes during a patient encounter or visit. |

| Truth in Lending | An agreement between the patient and the physician regarding monthly installments to pay a bill. A truth in lending statement must be signed when payments exceed a 4-month period. |

| TWIP | Take What Insurance Pays. |

| UCR | Usual, Customary, and Reasonable. The reimbursement method that establishes a maximum fee an insurance company will pay for services. |

| Utilization Review | A process of assessing medical services to assure medical necessity and the appropriateness of treatment. |

| Withhold Incentive | The percentage of payment held back for a risk account in the HMO program. Withhold arrangements are used to share potential losses or profits with providers of service. |

Introduction

Pegboard Systems

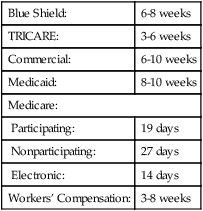

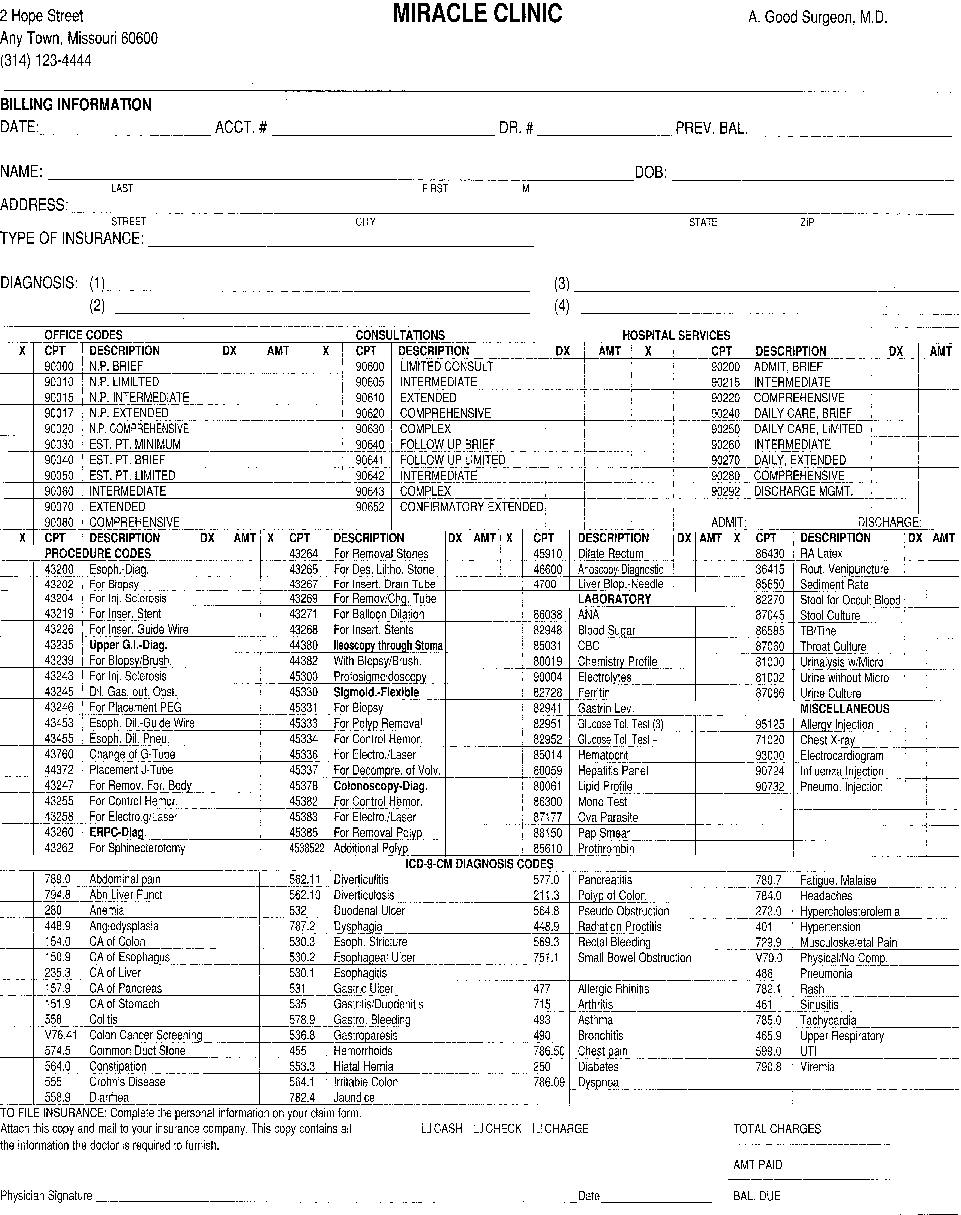

A pegboard system, also referred to as a “one-write system,” is a manual accounting system to track accounts receivable activity. This type of system requires superbills (Fig. 8-1), ledger cards or statements (Fig. 8-2), a day transaction sheet, a monthly journal form, and a special board to ensure the information is correctly entered on the forms.

Pegboard Elements

Ledger: Tracks patient billing activity, including charges, payments, and account activity.

Day Sheet/Journal: Tracks practice billing and collection activity, including patient charges, insurance payments, and cash transactions.

Statements/Ledger Card: A method to remind patients that their account has an open balance; this is usually sent on a 30-day rotation.

Insurance Participation

Precertification when necessary

Precertification when necessary

Obtaining authorization for service when necessary

Obtaining authorization for service when necessary

Utilizing other physicians who participate with the insurance program

Utilizing other physicians who participate with the insurance program

Utilizing hospital and outpatient facilities that participate with the insurance program

Utilizing hospital and outpatient facilities that participate with the insurance program

Payment Responsibility

A husband is responsible for his wife. However, a wife is not always responsible for claims incurred by the husband.

A husband is responsible for his wife. However, a wife is not always responsible for claims incurred by the husband.

A father is usually responsible for bills incurred on behalf of his children.

A father is usually responsible for bills incurred on behalf of his children.

An insurance company is responsible for claims under the Workers’ Compensation Act.

An insurance company is responsible for claims under the Workers’ Compensation Act.

In special circumstances a third-party guarantor may be responsible for the bill in the following cases:

In special circumstances a third-party guarantor may be responsible for the bill in the following cases:

Collection Policies

Advise patients of office payment policies before beginning treatment. When using this policy, the patient will know, before entering the office, whether payment is due at time of service or if the office will file the insurance before collecting from the patient.

Advise patients of office payment policies before beginning treatment. When using this policy, the patient will know, before entering the office, whether payment is due at time of service or if the office will file the insurance before collecting from the patient.

Establish and enforce a well-defined collection policy. Develop a specific method to monitor and handle accounts before they become a problem. Use a collection follow-up system for all patients in the practice.

Establish and enforce a well-defined collection policy. Develop a specific method to monitor and handle accounts before they become a problem. Use a collection follow-up system for all patients in the practice.

Send patients a statement every 30 days.

Send patients a statement every 30 days.

Send a second letter for accounts over 60 days.

Send a second letter for accounts over 60 days.

Send a notice informing the patient when the account will be turned over to a collection agency, usually after 90 days.

Send a notice informing the patient when the account will be turned over to a collection agency, usually after 90 days.