a. Example: The invoice states that you purchased 1/2 dozen mugs at $1.50 each, for a total of $9.00.

B. Selling price

- The selling price is 100% of the amount you will receive for the sale of an item (this includes your cost plus whatever amount you want as a profit).

C. Markup

- Markup is the difference between the cost for a product and its actual selling price.

Selling Price = Cost + Markup

- Example: For 30 tablets costing $0.40 each for which you want to receive $0.10 profit per tablet:

Selling Price = (30 × $0.40) + (30 × $0.10) = $12.00 + $3.00 = $15.00

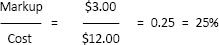

D. Percent markup

- Percent markup must be stated as either “percent markup on the selling price” or as “percent markup on the cost” to determine its true meaning. In retail practice, “percent markup” usually means percent of sales, not of cost.

a. From the previous example, percent markup based on cost would be:

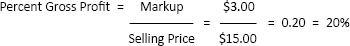

E. Percent gross profit

- Percent gross profit is the percent markup based on the selling price, instead of the cost.

a. Example:

F. Overhead

- It is important to consider overhead to determine the true profit of a business. Overhead includes operating costs such as utilities, taxes, insurance, and technician salaries.

G. Net profit

- Net profit can be defined as:

a. Selling Price – (Cost of Goods + Overhead)

H. Inventory

Stay updated, free articles. Join our Telegram channel

Full access? Get Clinical Tree